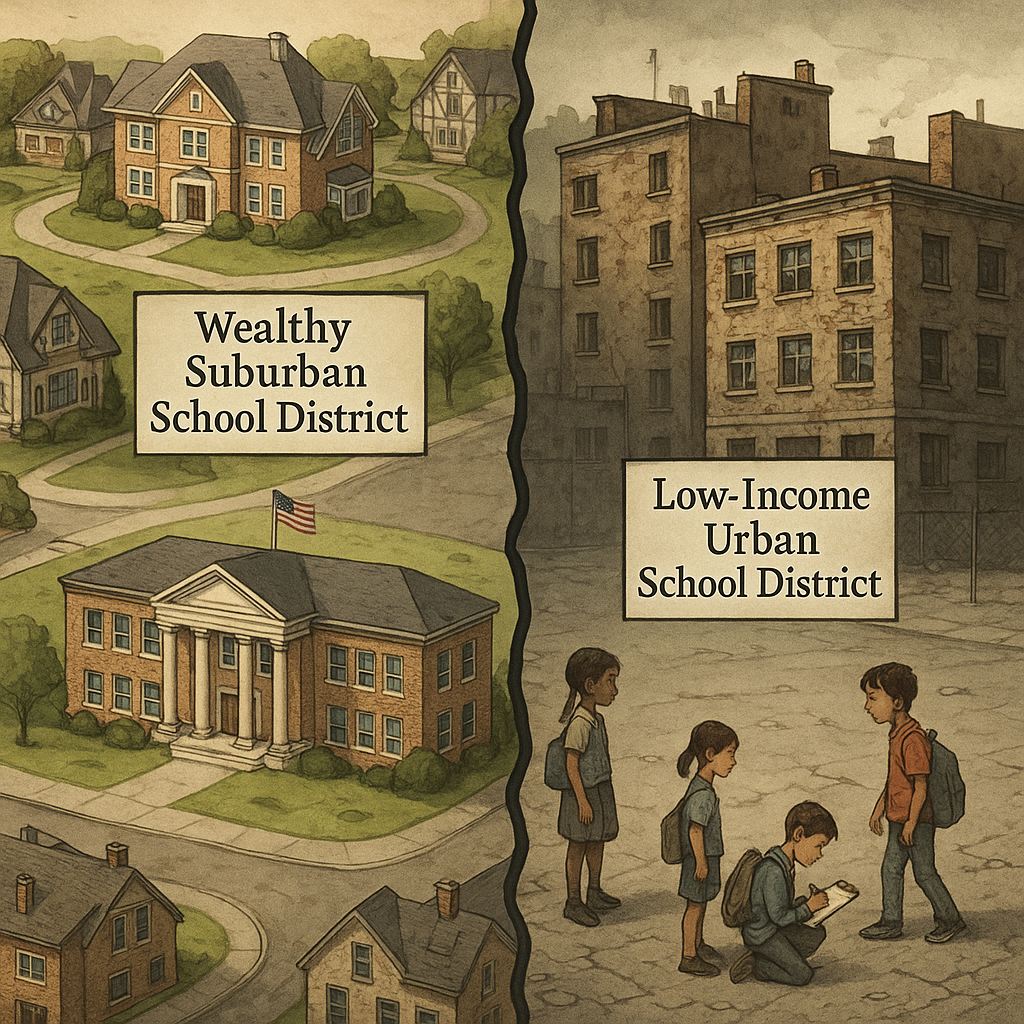

Under the current system, school tax inequality in the U.S. is not an accident it’s the result of structural policy. By relying heavily on local property taxes, the system guarantees that affluent districts receive significantly better funding, while low-wealth districts—often with majority low-income or minority populations are left behind. This imbalance shapes not just classrooms, but futures.

Why Property Taxes Drive School Tax Inequality in the U.S.

Across most states, local property taxes account for 40–50% of public school budgets. While state and federal funds supplement these amounts, wealthy districts with high property values can raise far more per student. Poorer districts, even with higher tax rates, often bring in far less.

For example, an affluent district might spend $17,000 per student, while a nearby low-wealth district struggles with $9,000 a direct result of unequal property wealth.

The Real-World Impact of School Tax Inequality in the U.S.

Unequal Funding Means Unequal Resources

Well-funded districts can provide smaller class sizes, veteran teachers, advanced placement courses, and strong extracurricular programs. Underfunded districts often rely on outdated textbooks, overcrowded classrooms, and inexperienced staff.

Legal Challenges Highlight Systemic Failures

Court cases like Serrano v. Priest (California, 1971) and William Penn School District v. Pennsylvania (2023) have challenged property-tax-based funding models as unconstitutional. Yet, many states still use this flawed system.

Racial and Economic Segregation Reinforced

Lower property values in historically segregated neighborhoods reduce available funding. Black and Latino communities are disproportionately affected, resulting in persistent opportunity gaps.

What the Data Shows

Federal and State Funds Don’t Close the Gap

While aid programs like Title I exist, they rarely make up for the full shortfall. Even after receiving supplemental funding, poor districts can remain thousands of dollars behind wealthy ones on a per-student basis.

Uneven Outcomes Across Districts

Per-student spending ranges from under $5,000 to over $15,000 depending on district wealth. This disparity directly impacts graduation rates, college readiness, and long-term earning potential.

Reform Ideas to Fix School Tax Inequality in the U.S.

- Implement state-level funding formulas that consider both local wealth and student need.

- Adopt uniform property tax models to ensure equitable effort across all districts.

- Increase federal aid and strengthen enforcement of Title I funding for high-poverty schools.

States that reform funding structures see measurable improvements in student achievement and reduced opportunity gaps.

Education Shouldn’t Depend on ZIP Code

School tax inequality in the U.S. isn’t just an economic issue it’s a moral one. When educational opportunity is tied to property wealth, the promise of public education as a great equalizer is broken. True reform means detaching funding from local property values and ensuring every child has the resources they need to succeed no matter their ZIP code.

Related Reading & Resources:

- Politics, Education and the Future of K‑12 – Lonnie Palmer’s insight into the political and financial roots of inequity in education.

- Unequal School Funding in the United States – ASCD overview of massive disparities in per-student funding (from under $4k to over $15k)

- Rethinking the Property Tax–School Funding Dilemma – Lincoln Institute’s recommendations for equitable tax and funding reform.

- Public Education Funding in the U.S. Needs an Overhaul – Economic Policy Institute’s analysis of how over-reliance on local funding deepens inequity.

Read more at Lonnie Palmer

4 Responses